Exploring customer retention for digital subscription brands: Research Headlines.

Let’s stick together.

The past few years have been a rollercoaster for digital-first brands. Subscription services—offering everything from entertainment and skill-building to doorstep deliveries and financial security—thrived as consumer habits shifted during the pandemic. Sign-ups surged, and many brands saw rapid growth during the early 2020s.

But as financial pressures have grown and competition intensifies, customers are re-evaluating their spending. Rising costs and shifting priorities mean that once-loyal subscribers are cancelling, switching, or scaling back. In this environment, reducing churn is not just a challenge—it’s essential for survival.

We wanted to gather some fresh insights to help brands with subscription services to navigate these challenges and improve their stickiness. Read on for some the key findings and recommendations from our exclusive research project ‘Let’s stick together’.

Research approach & scope

Our research combined video interviews, social media listening, and a survey of 1,000 UK digital consumers.

Video interviews

Social media listening

Robust online survey

What the research covered:

Profile of the customers who churn

Sectors most impacted by churn

Switching forces of customer churn

Role of Product-Market-Fit

Attitudes and context around churn

Which interventions are most impactful

Read the research headlines

01

Subscriptions are becoming a luxury.

Once-thriving digital subscriptions are being dropped en masse as consumers refocus shrinking budgets on brands that deliver real, tangible value.

“My financial situation made it impossible to keep paying for something unnecessary.”

AGREE:

My financial situation made it impossible to keep paying for something unnecessary.

02

All subscriptions are battling churn.

From media giants to once-celebrated digital start-ups, no brand is immune. A relentless focus on fulfilling customer needs is essential for survival.

“Either lower the prices or entice me with new features to keep me using the subscription.”

SERVICES DROPPED BY UK CONSUMERS – TOP 5 (Past 12 mths)

Video services

Insurance providers

Telecoms

Food & drink

Paid apps

03

Good is no longer good enough.

Loyalty is scarce for subscription brands that fall short. Closing gaps in price, product, and experience—compared to both user needs and competitors—is critical.

“The content wasn’t as riveting as expected. I want something that catches my attention, not bores me”

TOP 3 REASONS FOR CHURN

Service / product didn’t deliver to expectations

26%

It cost too much for what it offered

34%

There was a better alternative brand

33%

04

Subscription value is fading for users.

As prices rise—often without noticeable improvements—subscribers feel they’re paying more but getting less. Without better value, churn will accelerate.

“The cost has gone up over the last few months and it’s not worth paying that much for only a few meals.”

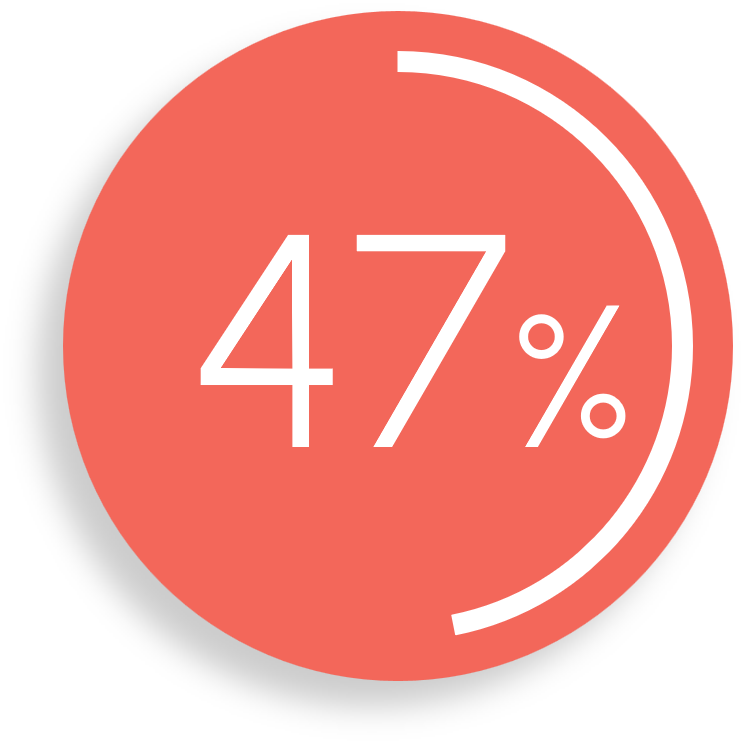

AGREE:

The value for money offered by subscription services is decreasing

05

Once essential, now a ‘nice to have.’

Digital subscriptions that filled key needs during and after COVID-19 now face high churn. As old behaviours return and costs rise, Product-Market Fit is under pressure.

“I had grown tired of the service and no longer felt like it contributed positively to my life”

% 18-34s AGREE:

I signed up to some subscriptions during the pandemic that I don't need anymore

06

Once the driving force behind digital subscription growth, younger audiences in particular are now feeling the pinch and rethinking their spending.

Young subscribers are cutting back.

“There was no discounted option or reduced service that could have made the subscription fee more manageable”

18-34s AGREE:

I have too many subscriptions and want to cut back

18-34s AGREE:

The mounting costs of subscriptions makes me worry

07

Some are only in it for the deal.

Special offers and free trials attract customers, but many never intend to pay full price. The service offer—not just the discount—needs to sell itself.

“I had a free period but ‘when it ended’ I swapped to another provider who gave me 3 months free”

AGREE:

I sometimes take free or reduced-cost subscription trials with no intention of paying full price

08

At-risk subscribers respond best to offers that limit costs and reward loyalty. But long-term retention depends on balancing pricing with ongoing quality and value.

Capping price will help cap churn.

“Don’t increase the premiums at renewal time. It seems unfair to be penalised for staying put with the company!”

WHAT WOULD KEEP SUBSCRIBERS LOYAL (TOP 5)

Fix / do not increase prices

Renewal offers / deals

Offer lower tiered options

Improve subscription quality

Offer more subscriber perks

09

Be missed or be dropped.

Subscriptions that fail to meet critical needs—or can be easily replaced—are the first to go. Strengthening Product-Customer Fit is key to retention.

“They were good, I have no issues with them I just feel I don’t need them anymore.”

SUBSCRIPTIONS THAT WOULD NOT BE MISSED (TOP 5)

Baby & childcare

Clothing & fashion

Health & beauty

Fitness & exercise

H’hold cleaning

SO WHAT SHOULD SUBS BRANDS DO? RECOMMENDATIONS SUMMARY

Maximising stickiness: In summary

Keeping customers is often harder than winning them. The days of relying on loyalty and inertia are over—today’s empowered consumers focus on real value and making the most of their limited budgets.

“Nothing new is ever added and if it is then it’s same stuff I can get elsewhere”

Ensure Product-Market-Fit

Be essential, be enduring, and beware of deal-seekers who churn quickly. The goal is to be missed if a subscriber chooses to leave.

Fight the pull of competitors

Subscribers want the best value for their money. Superior features, customer experience, pricing, and promotions all tempt them elsewhere.

Reward to retain

Don’t wait until it’s too late to recognise loyalty. Show subscribers they’re valued with incentives before renewal deadlines.

Don't push customers away

Misaligned value vs. price (especially ‘less for more’ trends), quality shortfalls, and poor CX/UX are all churn triggers.

Build barriers to churn

Continuously enhance value, quality, and experience. Create hooks, plant concerns—remind customers why they need you.

Down-sell (if needed)

It’s better to retain revenue by offering shorter contracts or lower-priced tiers than to lose subscribers entirely.